In affiliate marketing and performance-based marketing, choosing between CPA vs CPL vs revenue share isn’t a theory problem, it’s a cash flow problem.

Pick the wrong payout model and you’ll feel it fast: good click volume, bad approvals, slow payments, or a backend that never converts. Pick the right one and your numbers get simpler, your tracking gets cleaner, and scaling stops feeling like guessing.

In 2026, ad platforms and networks are stricter about compliance, lead validation, and refund risk. That makes “what counts as a conversion,” especially in CPA (Cost Per Action) models, just as important as the payout.

CPA, CPL, Revenue Share Commission Models in Affiliate Marketing: What You’re Really Buying

Affiliate networks offer CPA, CPL, and revenue share commission models with payout structures like how you get paid at a job.

CPA (Cost Per Action) is like a commission check; you only get paid when the sale happens. CPL (Cost Per Lead) is like getting paid for booking appointments, even if some don’t close. Revenue share is like owning a small slice of the business; you earn while customers keep paying.

Here’s the practical breakdown:

| Model | What counts | Payout timing | Pros | Cons | Risk profile |

|---|---|---|---|---|---|

| CPA (Cost Per Action) | Sale, deposit, paid signup, install (depends on CPA (Cost Per Action) offer) | Usually paid after verification, often net-7 to net-30, sometimes first payout hold | Fast cash flow when traffic is high intent, clean success metric | Can be hard to convert cold traffic, refunds and chargebacks can claw back | Medium |

| CPL (Cost Per Lead) | Form submit, quote request, trial lead, call lead (quality rules apply for CPL (Cost Per Lead)) | Often net-15 to net-30, with lead review and reversals | Low friction for users, works well top-of-funnel, common in verticals like insurance or finance | Lead scrubbing can reduce approvals, compliance is strict, caps are common | Medium to high |

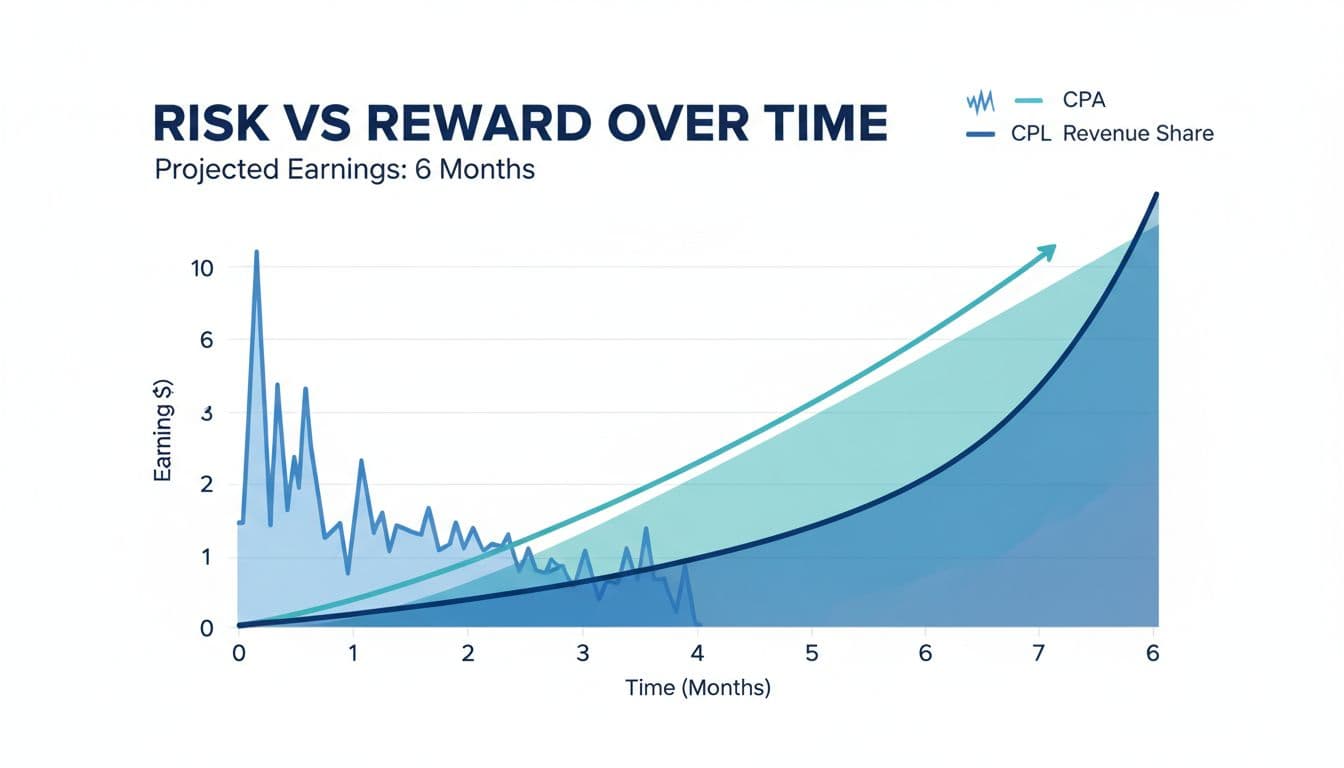

| Revenue Share | Percent of revenue from referred customers (for Revenue Share) | Monthly cycles, can lag 30 to 60 days behind acquisition | Compounds over time, can beat CPA long term | Slow start, churn can crush earnings, tracking must be solid | High (at first), then lowers |

A quick rule: if your traffic shows up ready to buy, CPA (Cost Per Action) is usually the simplest win. If your traffic shows up curious, CPL (Cost Per Lead) can monetize that interest. If your traffic trusts you and sticks around, revenue share can snowball.

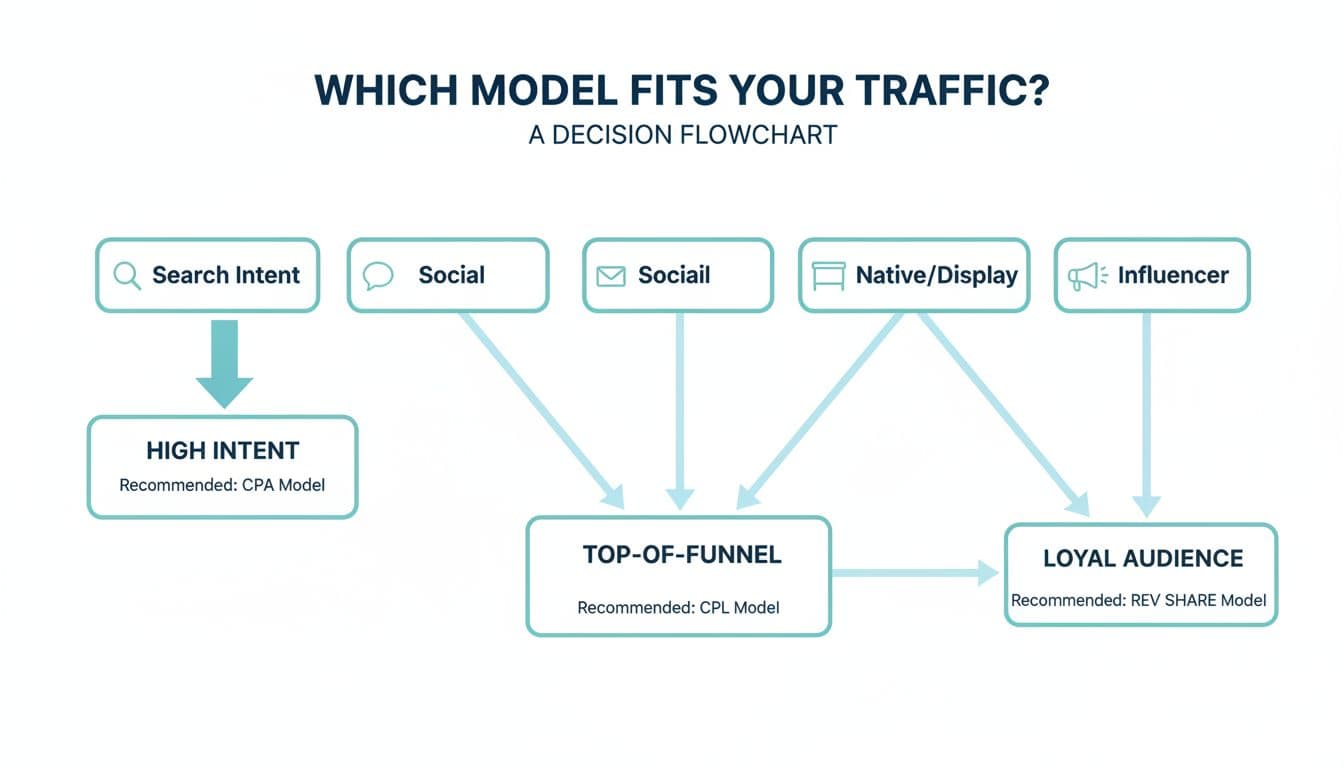

Picking the right model for your traffic source (SEO, paid social, native, email)

“Best offer type” changes with intent and target audience. Different segments in the sales funnel require unique approaches: a buyer searching “best X for Y” acts nothing like someone who clicked a meme ad.

Use this as a starting point, then confirm it with tracking:

| Traffic source | Usually best model | Why it fits | Watch-outs |

|---|---|---|---|

| SEO (commercial intent) | CPA or revenue share | Visitors are already problem-aware, comparison pages close well with strong conversion rates | Don’t send info-only traffic to strict CPA offers |

| Paid social (cold) | CPL first, then CPA retarget | Social clicks are often curious, leads are easier than sales given traffic quality | Low-quality leads can get reversed, creative must match landing page claims |

| Native/display | CPL or CPA with strong pre-sell | Pre-landers warm traffic up, reduces shock on the offer | Compliance and claims get reviewed, keep wording clean, landing page design must align |

| Email (permission-based) | Revenue share or CPA | Repeat touch points raise conversion and retention | List hygiene matters, spam complaints can kill deliverability |

| Influencer/community | Revenue share | Trust is the conversion engine, recurring products shine | Track attribution cleanly, coupon leaks can steal credit |

Two non-negotiables that decide outcomes:

CPL (Cost Per Lead) compliance and lead quality: Treat CPL (Cost Per Lead) like you’re selling “verified intent” through proper lead generation, not “a form fill.” Use clear consent language, match the promise to the form, avoid misleading “free” claims, and don’t incentivize low-effort submissions unless the advertiser allows it. Monitor duplicates, fake info, mismatched geo, and ultra-fast form times. If approval rate drops, your EPC will lie to you until reversals hit.

Revenue share retention and churn: Revenue share only works when customers stick. Watch churn drivers like weak onboarding, trial-to-paid drop-off, and payment failures. Customer Lifetime Value (CLV) is the ultimate metric to watch alongside basic retention signals (D7, D30, active subscribers). For CPA (Cost Per Action) or revenue share, if you can’t see at least those retention signals, you’re flying blind.

Do the math, then run a clean test (tracking, split plan, KPIs)

Don’t choose a payout model based on the headline payout. Choose it based on expected value and how fast you get paid.

Start with two simple formulas:

EPC (Earnings Per Click)

EPC = Total earnings / Total clicks

To evaluate overall success, also track ROI (Return on Investment) and ROAS (Return on Ad Spend) alongside EPC (Earnings Per Click).

Expected value per click (quick estimate)

- CPA (Cost Per Action) EV/click = (Conversion rate) × (Payout)

- CPL (Cost Per Lead) EV/click = (Lead rate) × (Payout) × (Lead approval rate)

- Rev share EV/click = (Customer rate) × (Monthly revenue) × (Rev share %) × (Expected paid months)

Example (hypothetical numbers):

If a CPA (Cost Per Action) offer pays $50 and converts at 1%, EV/click = 0.01 × 50 = $0.50.

If a CPL (Cost Per Lead) pays $10, your lead rate is 8%, and 70% approve (a rate that can vary with Single Opt-In (SOI) versus Double Opt-In (DOI) conversion flows), EV/click = 0.08 × 10 × 0.70 = $0.56.

Then test it like a media buyer, even if you’re doing “free” traffic.

A simple step-by-step offer selection and testing process

- Match the offer to intent: Cold traffic gets lower friction CPA (Cost Per Action) like CPI (Cost Per Install) or CPL (Cost Per Lead), warm traffic can take CPA (Cost Per Action), loyal audiences can support revenue share.

- Confirm conversion definitions: Ask what counts, what gets reversed, and what the hold looks like (many programs run net-15 to net-30, and revenue share often pays monthly).

- Set tracking before spend: Use subIDs for every placement, pass UTM parameters, and set postback or pixel events so you see leads, sales, and reversals in the conversion flow.

- Run a fair split: Start 50/50 between two offers or two payout models, keep creative and landing path as similar as possible.

- Wait for enough signal: Aim for at least 30 to 50 tracked conversions per variant when possible, then compare EPC and quality.

- Scale with guardrails: Increase budget in steps, keep a cap while you watch refunds, lead approvals, and churn.

KPIs that prevent nasty surprises

| Model | Primary KPI | Quality KPI | Traffic Cost KPIs | Lagging KPI to monitor |

|---|---|---|---|---|

| CPA (Cost Per Action) | EPC, conversion rate, CPC (Cost Per Click), CTR (Click-through rate) | Refund rate, chargebacks | CPM (Cost Per Mille) | Net revenue after clawbacks |

| CPL (Cost Per Lead) | EPC, cost per lead, CPC (Cost Per Click), CTR (Click-through rate) | Approval rate, duplicate rate | CPM (Cost Per Mille) | Reversal rate after review |

| Rev share | EPC, customer rate | Activation rate (first key action) | CPC (Cost Per Click), CPM (Cost Per Mille) | Churn, retention by month, LTV |

If you need faster cash flow to keep buying traffic, CPA (Cost Per Action) or CPL (Cost Per Lead) usually fits better. If you can wait and want compounding income, revenue share becomes more attractive, as long as retention is real.

Conclusion

The right choice comes down to intent, risk, and time. In performance-based marketing, CPA (Cost Per Action) pays for the sale, CPL (Cost Per Lead) pays for the lead (when it’s valid), and Revenue Share pays for staying power. Run the numbers, track reversals and churn, and test like you mean it to optimize for ROI (Return on Investment). Many advanced affiliates move toward a hybrid model that combines upfront payments with recurring revenue. When you treat CPA vs CPL vs revenue share as a fit problem instead of a payout problem, your traffic gets easier to monetize and scale.