You write the review, run the test, build the email sequence, and warm the lead for days. Then the commission lands somewhere else, or it’s smaller than expected. If you’ve been in performance marketing long enough, you’ve felt that sting. This frustration often signals affiliate fraud, which manifests through subtle credit shifts that leave you underpaid.

Most of the time, it’s not “bad luck.” It’s last click attribution plus a handful of program rules (and partner behaviors) that quietly create last-click traps, moving credit to the final touchpoint even when you did most of the work.

Why last click attribution creates commission “trap doors”

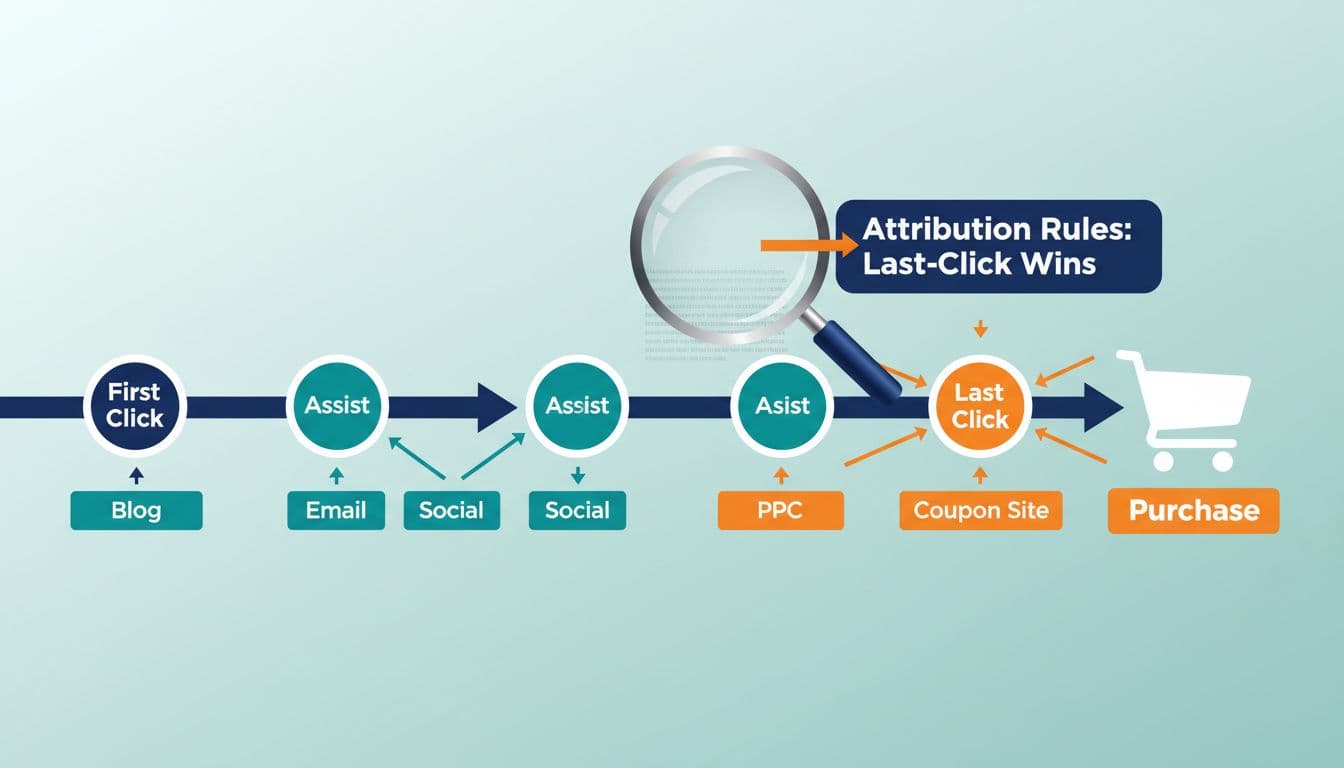

The user journey is a complex path with multiple assisted conversions. Think of attribution like a claim ticket on a purchase. In a pure last-click setup, the last eligible referrer before checkout holds the only ticket that matters. Everyone else becomes “assist” in the story, but not in the payout.

That’s not automatically unfair. Last click is simple to run and easy to explain. The problem is that affiliate ecosystems have lots of “last touches” that happen late in the buying flow, and many don’t add much value. Coupon sites, browser extensions, retargeting, brand search ads, even internal redirects can all show up right before payment. Coupon sites often act as bottom-of-funnel touchpoints that provide very little incremental value to the overall affiliate program compared to content creators.

Modern tracking in 2026 also makes the final touchpoint even more powerful and identifying these late-funnel interlopers more difficult. Cross-device shopping is normal, cookie consent varies by region, and some programs rely on first-party or server-side methods that you can’t easily verify from the outside. That can be good for match rates, but it can also hide how credit is assigned and which channels override affiliates.

If you want the merchant-side view of how payout outcomes change under different models and partner mixes, the PMA whitepaper on attribution models lays out why “who gets paid” depends as much on rules as on performance.

The most common last-click traps (with scenarios you can recognize fast)

Here are the patterns that show up again and again, even in programs that look clean on the surface.

Coupon poaching at the finish line. You drive a user with a “best for X” review, they’re ready to buy, then they search “Brand coupon” and click a coupon site. If the program is last-click, that coupon partner often takes 100% of the commission, even if the coupon wasn’t exclusive or didn’t change the decision. This common behavior amounts to attribution theft.

Toolbar or extension overwrites. Some shopping extensions pop a reminder, auto-apply codes, or trigger an “activation” click during checkout. That action can involve cookie stuffing to drop a fresh affiliate click on top of yours. You’ll see this when your click volumes look normal, but conversions are oddly low on high-intent pages.

Brand-bidding cannibalization. A partner runs paid search on the merchant’s brand (or close variants). Your content generates awareness, the user later searches the brand name, clicks the ad, and your commission disappears. Even if brand bidding is “not allowed,” enforcement varies, and it exposes you to ad fraud risks including click fraud variants.

Short cookie windows that don’t match the buying cycle. A 24-hour window can be fine for impulse buys, but it’s brutal for software trials, higher-ticket items, and “sleep on it” decisions. Also watch for session-only attribution. For a deeper breakdown, see Understanding Affiliate Cookie Windows.

Server-side redirects and channel de-dupe rules. Some merchants route traffic through internal redirectors, app opens, or payment flows using click injection or redirect tampering that can reset the “last known source.” Others run de-duplication where email, paid search, or “direct” takes priority over affiliates. The result can look like random tracking loss, but it’s really a rules hierarchy.

“New customer only” mislabeling. The program promises a high CPA for new customers, but “new” might mean “new to this device,” “new to this cookie,” or “no purchase in 30 days.” If your audience includes returning buyers, you can generate lots of sales that get reclassified and paid at a lower rate, or reversed.

These patterns often represent affiliate fraud, requiring fraud prevention measures to protect your conversion rate and ensure the affiliate program remains profitable. For a solid technical view of modern measurement headaches around analytics and referral loss, this GA4 affiliate attribution challenges write-up is worth skimming.

Run a quick attribution vetting process before you scale traffic

You don’t need the merchant’s full data to spot last-click traps. You need a repeatable process and a few controlled tests.

- Map your real user paths. Pull top landing pages, top exit pages, and typical time-to-buy from your analytics and email platform. This tells you whether a 24-hour cookie is realistic.

- Tag everything with subIDs. Use placement-level IDs for page, link location, email, and ad set, leveraging tracking parameters and subIDs as a core affiliate program strategy. If the program doesn’t support subIDs, that’s already a risk signal.

- Run a “no coupon” control. On a small segment, remove coupon language and avoid teaching people to search for codes. If conversion rate stays similar but credited sales rise, coupon poaching was likely.

- Test late-funnel clicks. Do a clean click, wait, then simulate common behaviors (open a coupon site, click a retargeting ad if you see one, switch devices). Watch whether your click remains “last.”

- Check reversals by segment. Break reversals out by traffic source, landing page, and device. Checking reversals by segment helps identify invalid traffic and issues with traffic quality; “New customer only” and brand bidding issues often show up as patterned reversals.

- Compare network vs merchant reports (if available). Look for data anomalies in order counts, order values, or timestamp alignment. Big gaps usually mean rule-based filtering.

- Ask for the written rule stack. Cookie length is only one line. You need to know attribution priority, de-dupe logic, and promo code handling. Advocate for real-time monitoring to confirm the incremental value of your traffic, which ultimately protects your commission payouts and overall conversion rate within the affiliate program.

If you want a broader screening process you can reuse before joining (or scaling) any offer, bookmark this Affiliate Program Vetting Checklist.

When you suspect last-click traps, push the conversation toward incrementality and rule clarity. This guide on affiliate measurement and incrementality is useful context for the kinds of tests merchants already understand.

Questions to ask the affiliate manager (plus two email templates)

Ask direct questions that force specifics:

- Which attribution model is used (pure last click, last paid click, session-only, position-based, multi-touch)?

- Do coupon partners or toolbars get special treatment (higher priority, overwrite allowed, “assists” paid)?

- What is the cookie window (such as 30 days versus a lifetime cookie), and does it differ by device, browser, or in-app traffic?

- How do promo codes attribute (last-click, code owner, “best price,” or rules-based)?

- Is brand bidding allowed, and how is it monitored and enforced?

- What channels override affiliates (paid search, email, direct, internal apps, call center)?

- How is “new customer” defined, and is it audited?

- What is the approval and locking timeline, and typical reversal reasons?

- What fraud detection software is used, and how are sub-networks monitored?

- Is tracking first-party or server-side, and what breaks attribution (consent decline, ITP, cross-device)?

- Can you share a sample path report or a written policy summary for partners?

Email template 1 (clarify rules)

Subject: Attribution rules clarification for [Program Name]

Hi [Name], I’m a partner focused on affiliate recruitment standards, planning to scale content and email traffic for [Program Name].

Can you confirm in writing: attribution model (last click or other), cookie window by device, promo code attribution rules, and any channel de-dupe that can override affiliate credit (paid search, email, direct, app)?

If you have a partner policy doc, please send it. Thanks, [Your Name]

Email template 2 (request a change or exception)

Subject: Request: protect content-driven attribution

Hi [Name], As a small affiliate, my placements generate early-funnel demand, but we’re seeing signs of last-click overrides (coupon and late-funnel clicks) due to affiliate fraud like ad fraud and cookie stuffing at the finish line.

Are you open to one of these options: content partner protection window, code-based attribution for my unique code, or a shared-credit model for assist paths? To help protect assisted conversions in the affiliate program, can you also share your fraud prevention protocols?

I can provide subID-level data and run a short incrementality test. Best, [Your Name]

Quick compliance and privacy note (don’t skip this)

Keep FTC endorsement disclosures clear and close to affiliate links, especially in email and social. On tracking, avoid collecting or sharing sensitive user data via subIDs, and don’t try to fingerprint users to “fix” attribution. In 2026, merchants care about consent-friendly, first-party approaches, and so should you.

Conclusion

Last-click traps in last click attribution models don’t always look like click fraud or attribution theft. More often, they’re “normal” rules that quietly reward whoever shows up last. When you audit these behaviors with a fraud prevention mindset, ask for the written rule stack, scout for last-click traps at the bottom-of-funnel, and push for code rules or partner protections, you safeguard the integrity of your affiliate program and protect your commissions. The next time a program looks generous on paper, run the quick audit first; it’s your best defense against affiliate fraud, then scale traffic with confidence.